New Jersey Vs New York Income Taxes . a new jersey resident working in the state at your salary level would incur tax of $7,365 based on 2021 tax rates, said neil becourtney, a certified public accountant and tax partner with. Use this tool to compare. Your employer will have withheld new york state taxes throughout the year but you’ll need to file in new jersey as well. The lowest rate is 4%, and the highest rate is 10.9%. new york has nine income tax rates: Are you considering moving or earning income in another state? in 2024, california, hawaii, new york, new jersey and washington d.c. New york has a state sales tax rate of 4.00% and an. Have some of the highest marginal state income tax rates, with. does new york or new jersey have lower sales taxes? at first blush, the key difference between the two states’ tax base is that new jersey generally imposes a tax on gross.

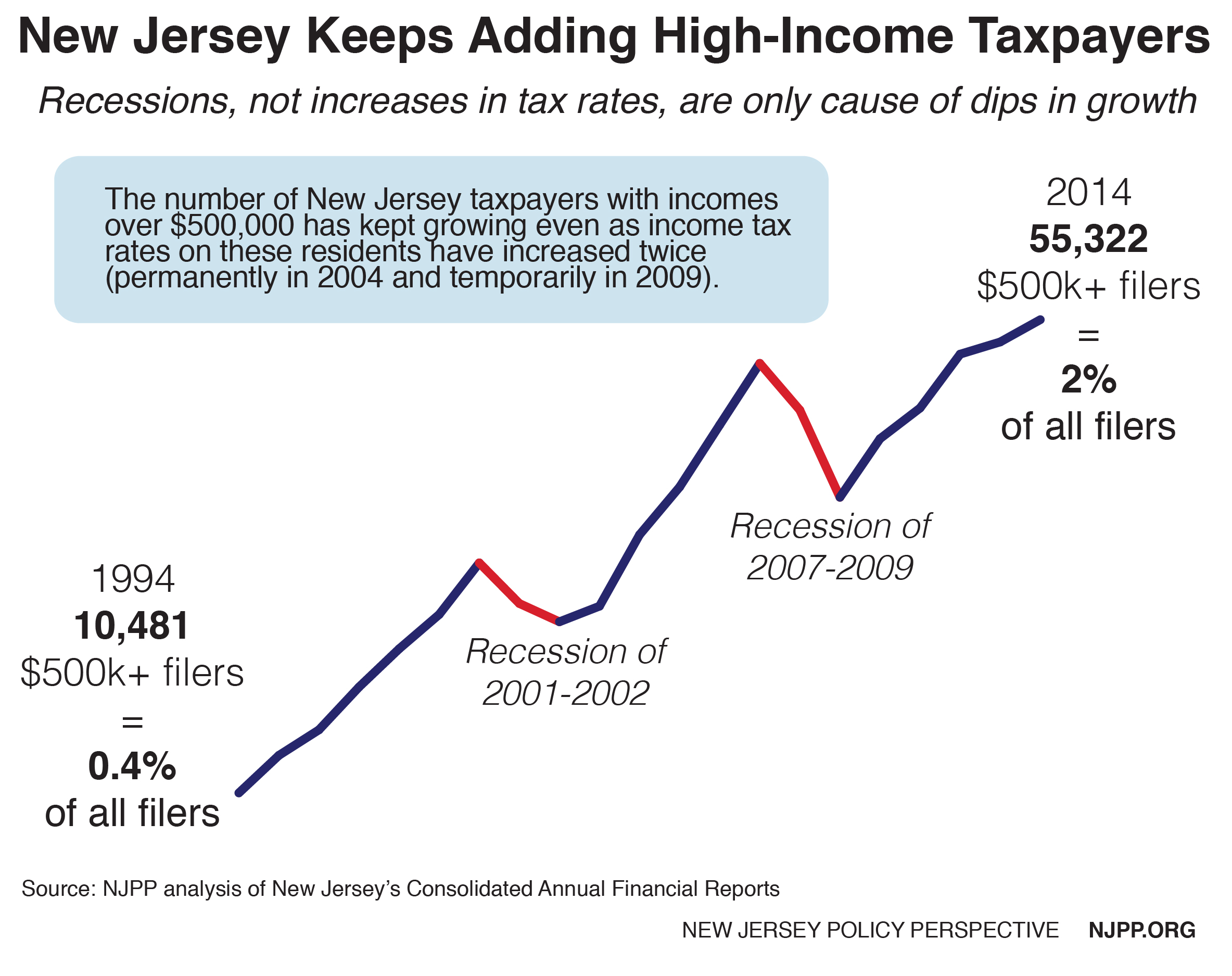

from www.njpp.org

The lowest rate is 4%, and the highest rate is 10.9%. Use this tool to compare. a new jersey resident working in the state at your salary level would incur tax of $7,365 based on 2021 tax rates, said neil becourtney, a certified public accountant and tax partner with. Are you considering moving or earning income in another state? new york has nine income tax rates: does new york or new jersey have lower sales taxes? in 2024, california, hawaii, new york, new jersey and washington d.c. at first blush, the key difference between the two states’ tax base is that new jersey generally imposes a tax on gross. Your employer will have withheld new york state taxes throughout the year but you’ll need to file in new jersey as well. New york has a state sales tax rate of 4.00% and an.

Reforming New Jersey’s Tax Would Help Build Shared Prosperity

New Jersey Vs New York Income Taxes does new york or new jersey have lower sales taxes? Your employer will have withheld new york state taxes throughout the year but you’ll need to file in new jersey as well. New york has a state sales tax rate of 4.00% and an. The lowest rate is 4%, and the highest rate is 10.9%. Use this tool to compare. does new york or new jersey have lower sales taxes? in 2024, california, hawaii, new york, new jersey and washington d.c. new york has nine income tax rates: at first blush, the key difference between the two states’ tax base is that new jersey generally imposes a tax on gross. Are you considering moving or earning income in another state? a new jersey resident working in the state at your salary level would incur tax of $7,365 based on 2021 tax rates, said neil becourtney, a certified public accountant and tax partner with. Have some of the highest marginal state income tax rates, with.

From colorfity.weebly.com

New york tax brackets 2021 colorfity New Jersey Vs New York Income Taxes at first blush, the key difference between the two states’ tax base is that new jersey generally imposes a tax on gross. Use this tool to compare. Have some of the highest marginal state income tax rates, with. new york has nine income tax rates: does new york or new jersey have lower sales taxes? a. New Jersey Vs New York Income Taxes.

From taxfoundation.org

State Corporate Tax Rates and Brackets for 2020 New Jersey Vs New York Income Taxes Your employer will have withheld new york state taxes throughout the year but you’ll need to file in new jersey as well. The lowest rate is 4%, and the highest rate is 10.9%. Use this tool to compare. New york has a state sales tax rate of 4.00% and an. at first blush, the key difference between the two. New Jersey Vs New York Income Taxes.

From mollylewis.pages.dev

New York State Capital Gains Tax Rate 2025 Molly Lewis New Jersey Vs New York Income Taxes at first blush, the key difference between the two states’ tax base is that new jersey generally imposes a tax on gross. Use this tool to compare. Your employer will have withheld new york state taxes throughout the year but you’ll need to file in new jersey as well. does new york or new jersey have lower sales. New Jersey Vs New York Income Taxes.

From pocketsense.com

Tax Advantages of New Jersey Vs. New York City Pocket Sense New Jersey Vs New York Income Taxes at first blush, the key difference between the two states’ tax base is that new jersey generally imposes a tax on gross. Use this tool to compare. The lowest rate is 4%, and the highest rate is 10.9%. Have some of the highest marginal state income tax rates, with. does new york or new jersey have lower sales. New Jersey Vs New York Income Taxes.

From talyayharriett.pages.dev

New York State Tax Brackets 2024 Heddi Kristal New Jersey Vs New York Income Taxes at first blush, the key difference between the two states’ tax base is that new jersey generally imposes a tax on gross. a new jersey resident working in the state at your salary level would incur tax of $7,365 based on 2021 tax rates, said neil becourtney, a certified public accountant and tax partner with. in 2024,. New Jersey Vs New York Income Taxes.

From pocketsense.com

Tax Advantages of New Jersey Vs. New York City Pocket Sense New Jersey Vs New York Income Taxes Your employer will have withheld new york state taxes throughout the year but you’ll need to file in new jersey as well. at first blush, the key difference between the two states’ tax base is that new jersey generally imposes a tax on gross. Use this tool to compare. in 2024, california, hawaii, new york, new jersey and. New Jersey Vs New York Income Taxes.

From www.youtube.com

CRITICAL INFO buying a house in New Jersey vs. New York taxes New Jersey Vs New York Income Taxes in 2024, california, hawaii, new york, new jersey and washington d.c. Your employer will have withheld new york state taxes throughout the year but you’ll need to file in new jersey as well. does new york or new jersey have lower sales taxes? New york has a state sales tax rate of 4.00% and an. Have some of. New Jersey Vs New York Income Taxes.

From brokeasshome.com

new york state tax tables New Jersey Vs New York Income Taxes Your employer will have withheld new york state taxes throughout the year but you’ll need to file in new jersey as well. in 2024, california, hawaii, new york, new jersey and washington d.c. Have some of the highest marginal state income tax rates, with. New york has a state sales tax rate of 4.00% and an. does new. New Jersey Vs New York Income Taxes.

From exozllewy.blob.core.windows.net

New Jersey Vs New York Tax at Danny Ritter blog New Jersey Vs New York Income Taxes Use this tool to compare. new york has nine income tax rates: a new jersey resident working in the state at your salary level would incur tax of $7,365 based on 2021 tax rates, said neil becourtney, a certified public accountant and tax partner with. Are you considering moving or earning income in another state? at first. New Jersey Vs New York Income Taxes.

From itep.org

New Jersey Policy Perspective Road to Recovery Reforming New Jersey’s New Jersey Vs New York Income Taxes does new york or new jersey have lower sales taxes? New york has a state sales tax rate of 4.00% and an. The lowest rate is 4%, and the highest rate is 10.9%. a new jersey resident working in the state at your salary level would incur tax of $7,365 based on 2021 tax rates, said neil becourtney,. New Jersey Vs New York Income Taxes.

From bitcoinethereumnews.com

Here are the federal tax brackets for 2023 vs. 2022 New Jersey Vs New York Income Taxes Use this tool to compare. New york has a state sales tax rate of 4.00% and an. Are you considering moving or earning income in another state? Have some of the highest marginal state income tax rates, with. does new york or new jersey have lower sales taxes? new york has nine income tax rates: The lowest rate. New Jersey Vs New York Income Taxes.

From taxfoundation.org

Combined State and Average Local Sales Tax Rates Tax Foundation New Jersey Vs New York Income Taxes new york has nine income tax rates: Are you considering moving or earning income in another state? Your employer will have withheld new york state taxes throughout the year but you’ll need to file in new jersey as well. at first blush, the key difference between the two states’ tax base is that new jersey generally imposes a. New Jersey Vs New York Income Taxes.

From giobswkju.blob.core.windows.net

New Jersey Vs New York Property Taxes at Michael Jaffe blog New Jersey Vs New York Income Taxes Have some of the highest marginal state income tax rates, with. The lowest rate is 4%, and the highest rate is 10.9%. at first blush, the key difference between the two states’ tax base is that new jersey generally imposes a tax on gross. in 2024, california, hawaii, new york, new jersey and washington d.c. a new. New Jersey Vs New York Income Taxes.

From giobswkju.blob.core.windows.net

New Jersey Vs New York Property Taxes at Michael Jaffe blog New Jersey Vs New York Income Taxes Your employer will have withheld new york state taxes throughout the year but you’ll need to file in new jersey as well. does new york or new jersey have lower sales taxes? Are you considering moving or earning income in another state? The lowest rate is 4%, and the highest rate is 10.9%. in 2024, california, hawaii, new. New Jersey Vs New York Income Taxes.

From www.youtube.com

New Jersey and New York Compared YouTube New Jersey Vs New York Income Taxes Use this tool to compare. in 2024, california, hawaii, new york, new jersey and washington d.c. New york has a state sales tax rate of 4.00% and an. The lowest rate is 4%, and the highest rate is 10.9%. does new york or new jersey have lower sales taxes? Are you considering moving or earning income in another. New Jersey Vs New York Income Taxes.

From www.businessinsider.com

How much it costs to live in New Jersey versus New York City Business New Jersey Vs New York Income Taxes Your employer will have withheld new york state taxes throughout the year but you’ll need to file in new jersey as well. New york has a state sales tax rate of 4.00% and an. Use this tool to compare. in 2024, california, hawaii, new york, new jersey and washington d.c. The lowest rate is 4%, and the highest rate. New Jersey Vs New York Income Taxes.

From exozllewy.blob.core.windows.net

New Jersey Vs New York Tax at Danny Ritter blog New Jersey Vs New York Income Taxes a new jersey resident working in the state at your salary level would incur tax of $7,365 based on 2021 tax rates, said neil becourtney, a certified public accountant and tax partner with. does new york or new jersey have lower sales taxes? Have some of the highest marginal state income tax rates, with. new york has. New Jersey Vs New York Income Taxes.

From www.njpp.org

Reforming New Jersey’s Tax Would Help Build Shared Prosperity New Jersey Vs New York Income Taxes The lowest rate is 4%, and the highest rate is 10.9%. Use this tool to compare. Are you considering moving or earning income in another state? new york has nine income tax rates: at first blush, the key difference between the two states’ tax base is that new jersey generally imposes a tax on gross. Have some of. New Jersey Vs New York Income Taxes.